The Company’s operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS.

The financial data presented is for the quarters ended March 31, 2016 (1Q16), December 31, 2016 (4Q16) and March 31, 2017 (1Q17), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

HIGHLIGHTS

- In 1Q17, Embraer delivered 18 commercial and 15 executive (11 light and 4 large) jets, representing a decline from the 21 commercial and 23 executive (12 light and 11 large) jet deliveries in 1Q16;

- The Company’s firm order backlog ended the quarter at US$ 19.2 billion;

- Revenues in 1Q17 were US$ 1,026.3 million, representing a decline of 21.6% as compared to 1Q16, due largely to a decline in commercial jet and executive jet deliveries;

- Adjusted EBIT and Adjusted EBITDA1 margins were 3.0% and 10.1%, respectively, in 1Q17. Adjusted EBIT and Adjusted EBITDA exclude the impact of US$ 7.6 million in additional provisions related to the Company’s voluntary dismissal program;

- 1Q17 Net income attributable to Embraer shareholders and Earnings per ADS were US$ 42.5 million and US$ 0.23, respectively. Adjusted Net income (excluding the impact of FX-related non-cash deferred income tax and social contribution and the aforementioned provision) for the quarter was US$ 23.2 million, representing Adjusted Earnings per ADS of US$ 0.13 in 1Q17;

- In January, Embraer issued US$ 750 million in principal value of bonds at par, with maturity in 2027 and a coupon rate of 5.4%. The Company finished 1Q17 with a total cash position of US$ 3,482.0 million and total debt of US$ 4,287.8 million, yielding a net debt position of US$ 805.8 million;

- In March, the Company announced that it successfully completed the inaugural flight of the first prototype of the E-195 E2 commercial jet, several months ahead of schedule. All three jet models of the E2 program remain on track for their respective entry into service plans – the E-190 E2 in the first half of 2018, the E-195 E2 in the first half of 2019 and the E-175 E2 in 2021;

- Embraer reiterates all aspects of its financial and delivery outlook for 2017.

REVENUES AND GROSS MARGIN

In 1Q17, Embraer delivered 18 commercial and 15 executive aircraft (11 light jets and 4 large jets), for a total of 33 jets delivered in the quarter. This compares to deliveries of 44 jets in 1Q16, consisting of 21 commercial and 23 executive aircraft (12 light jets and 11 large jets). The Company’s first quarter deliveries are generally the weakest in terms of seasonality, and Embraer remains confident in its 2017 guidance for 97 to 102 total commercial jet deliveries and 105 to 125 total executive jet deliveries (70-80 light jets and 35-45 large jets).

Revenues in 1Q17 were US$ 1,026.3 million, representing a decline of 21.6% compared to the prior year period, as a result of lower commercial and executive jet deliveries, as well as the postponement of the Geostationary Defense and Communications Satellite (SGDC) launch, initially scheduled for 1Q17, due to a general strike in French Guiana. Consolidated gross margin declined from 20.0% in 1Q16 to 15.1% in 1Q17, largely due to a less favorable mix and lower deliveries in the Executive Jets segment combined with the postponement of the satellite launch, which caused milestone-related revenues to shift to later this year.

EBIT

EBIT and EBIT margin in 1Q17 were US$ 23.4 million and 2.3%, respectively, down from US$ 85.7 million in EBIT and 6.5% EBIT margin reported in 1Q16. Adjusted EBIT and EBIT margin, excluding a US$ 7.6 million provision related to the Company’s voluntary dismissal program, were US$ 31.0 million and 3.0%, respectively. The year-over-year decline in revenues and its impact on fixed cost dilution, combined with the aforementioned lower gross margin, were the main drivers of the decline in adjusted EBIT margin in 1Q17 as compared to 1Q16.

Administrative expenses totaled US$ 42.6 million in 1Q17, which was a slight increase from the US$ 39.0 million reported in 1Q16, largely driven by a less favorable exchange rate in the current year’s quarter, as the average Brazilian Real to U.S. Dollar exchange rate in 1Q17 appreciated 19% relative to the average exchange rate in 1Q16. Selling expenses declined from US$ 101.4 million in 1Q16 to US$ 70.9 million in 1Q17, due largely to cost efficiencies and lower marketing-related expenses in the Executive Jets segment during the quarter.

Research expenses rose slightly to US$ 8.2 million in 1Q17 from US$ 6.6 million in the prior year, principally due to the aforementioned less favorable exchange rate in the quarter. Other operating income (expense) improved to an expense of US$ 9.3 million (US$ 1.7 million in expense excluding the voluntary dismissal program provision) in 1Q17 as compared to an expense of US$ 28.5 million in 1Q16 principally due to lower provisions for impairment of used aircraft in 1Q17.

NET INCOME

Net income attributable to Embraer shareholders and earnings per ADS for 1Q17 were US$ 42.5 million and US$ 0.23 per basic share, respectively. This compares to net income attributable to Embraer shareholders and earnings per ADS in 1Q16 of US$ 103.9 million and US$ 0.57 per basic share, respectively. Adjusted net income (loss), excluding deferred income tax and social contribution as well as the impact of the voluntary dismissal program provision, was US$ 23.2 million in 1Q17 as compared to US$ (1.7) in 1Q16. Adjusted earnings per ADS excluding deferred income tax and social contributio.

TOTAL BACKLOG

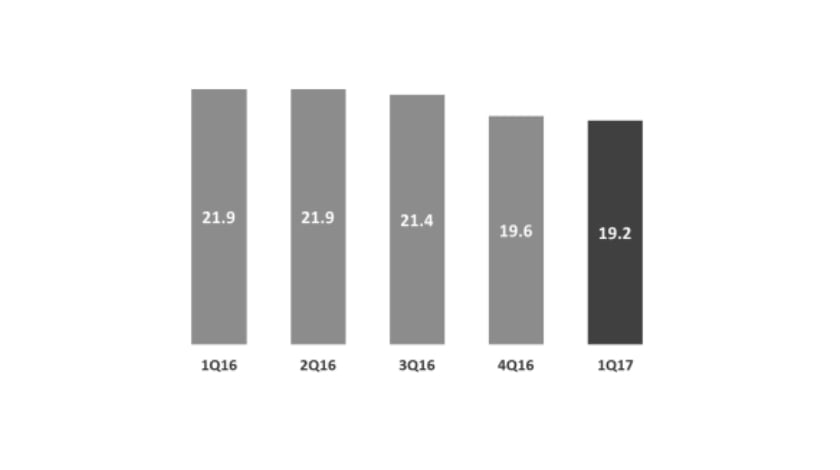

Considering all deliveries as well as firm orders obtained during the period, the Company’s total firm order backlog decreased US$ 0.4 billion during 1Q17 to end the quarter at US$ 19.2 billion.